Investing in Atlas Lithium (ATLX) presents a compelling but complex opportunity. This instructional guide analyzes ATLX's potential trajectory by 2025, weighing the bullish predictions against significant risks. Remember, this is for informational purposes only and does not constitute financial advice. Always conduct thorough due diligence before making any investment decisions. For more info on future market predictions, check out this useful resource.

Understanding the Lithium Market: A Dynamic Landscape

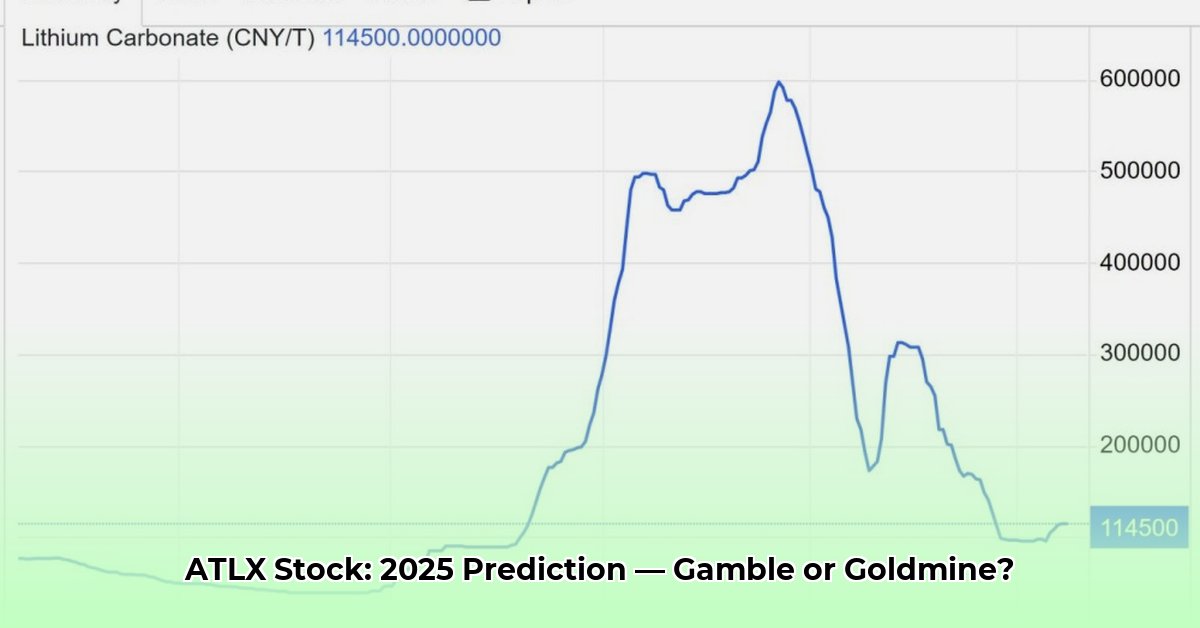

The lithium market is experiencing explosive growth, primarily driven by the burgeoning electric vehicle (EV) sector and the increasing demand for energy storage solutions. This surge in demand is creating a favorable environment for lithium producers like ATLX. However, the market’s dynamism presents both opportunities and significant challenges. Supply chain bottlenecks, geopolitical instability, and fluctuating production costs can dramatically influence prices, creating considerable volatility. How will these evolving dynamics impact ATLX's prospects?

Atlas Lithium (ATLX): A Deep Dive into Fundamentals

ATLX's success hinges on several key factors. A comprehensive assessment requires careful analysis of its financial health, operational efficiency, resource reserves, ESG performance, debt levels, and management quality. Recent market fluctuations highlight the importance of a nuanced understanding of these factors.

Key Performance Indicators for ATLX:

Financial Health: A strong balance sheet, characterized by profitability and sufficient cash reserves, is crucial for weathering market downturns. A detailed review of ATLX's financial statements, including income statements and cash flow statements, is essential. Is ATLX demonstrably profitable, or are substantial losses impacting its long-term viability?

Operational Efficiency: ATLX's operational efficiency directly impacts its profitability. Analyzing key metrics such as production costs per ton of lithium and the utilization rate of its production facilities is crucial. What initiatives is ATLX undertaking to enhance its production efficiency and reduce operational costs?

Resource Reserves: The size and quality of ATLX's lithium reserves are fundamental to its long-term growth potential. Independent assessments of the reserves' quantity and grade are essential to determine the company's potential lifespan and production capacity. How extensive are ATLX's proven and probable reserves, and what is the estimated lifespan of these reserves at current production rates?

ESG Performance: Increasingly, investors are incorporating environmental, social, and governance (ESG) factors into their investment decisions. ATLX's commitment to sustainable practices and its social responsibility initiatives will influence investor sentiment and long-term value. How does ATLX's commitment to ESG factors compare to its competitors in the lithium industry?

Debt Levels: High debt levels can restrict a company's financial flexibility and increase its vulnerability to economic downturns. A close examination of ATLX's debt-to-equity ratio and its debt repayment schedule is therefore necessary. What strategies does ATLX employ to manage its debt exposure and maintain financial stability?

Management Quality: The competency and experience of ATLX's management team are vital for guiding the company's strategic direction and navigating market challenges. Analyzing the team's track record in the lithium industry and their ability to execute their business plan is crucial. How does the experience and expertise of ATLX’s management team compare to that of its competitors?

Risk Assessment and Mitigation: A Strategic Approach

Investing in ATLX involves inherent risks. A comprehensive risk assessment is critical for informed decision-making.

| Risk Factor | Likelihood | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Lithium Price Volatility | Very High | Very High | Diversify investments; explore hedging strategies using derivatives. |

| Geopolitical Instability | Medium | High | Monitor geopolitical events impacting lithium production and demand. |

| Operational Challenges | Medium | Medium | Assess ATLX's risk management protocols and innovation capacity. |

| Regulatory Changes | Medium | High | Track regulatory developments impacting lithium mining operations. |

| Competition | High | Medium | Analyze ATLX's competitive advantages and its market share. |

Investment Strategies: Tailoring Your Approach

The optimal investment strategy is highly dependent on individual risk tolerance, investment horizon, and financial goals.

Conservative Investors: A small allocation to ATLX, balanced with more conservative investments, might be considered. This approach prioritizes capital preservation over maximizing potential returns.

Growth-Oriented Investors: ATLX potentially offers significant growth opportunities, but it's crucial to accept the higher risk associated with this potential. Thorough due diligence is paramount.

Long-Term Investors: A longer time horizon allows for weathering market fluctuations. Focus on ATLX's long-term growth potential within the expanding lithium market. This strategy requires patience and a tolerance for short-term volatility.

Conclusion: Navigating the ATLX Opportunity

Predicting ATLX's performance in 2025 requires considering numerous interwoven factors. While the potential for substantial returns exists, it's equally important to recognize the substantial risks. This guide provides a framework for informed decision-making. However, independent research and a careful assessment of your risk tolerance are crucial before investing in ATLX or any other stock. Remember, this is not financial advice.